BIGTREE Medicare & Nursing Home

Need help? Call Us Now : +6012 685 5103

Need help? Call Us Now : +6012 685 5103

What Your Medical Card Won’t Tell You About Post-Hospital Care

- Home

- What Your Medical Card Won’t Tell You About Post-Hospital Care

What Your Medical Card Won’t Tell You About Post-Hospital Care

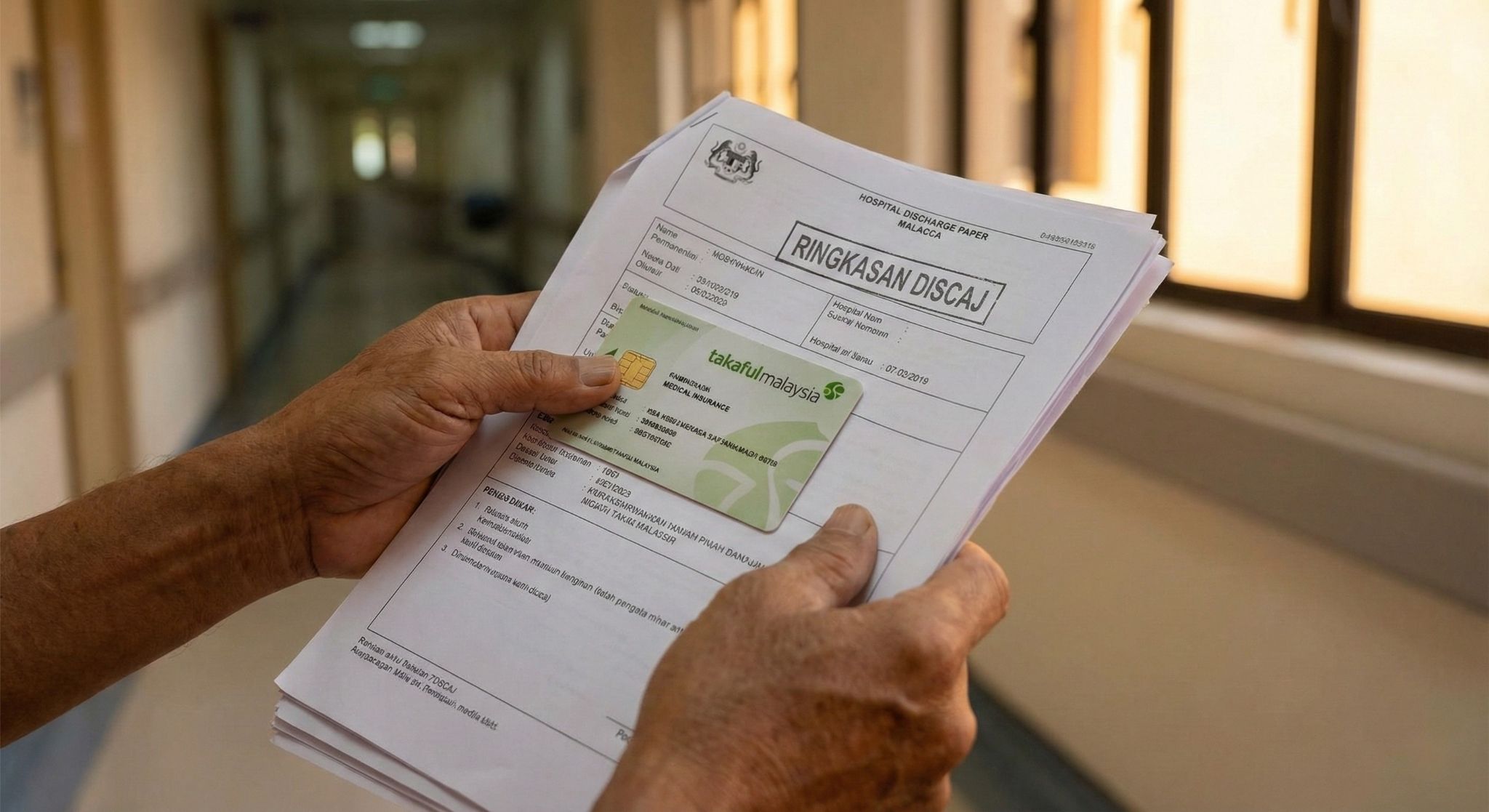

It happens more often than families expect. A parent gets discharged after surgery or a stroke. The doctor recommends weeks of professional nursing care and rehabilitation. The family assumes their medical card will cover it.

Then the shock: claim denied.

Understanding what insurance actually covers—and the fine print that can trip families up—could save thousands in unexpected costs.

The Critical Distinction Most Families Miss

Before discussing insurance, there’s something that directly determines whether claims get approved or rejected.

Malaysia has two completely different types of eldercare facilities:

MOH-licensed nursing homes are healthcare facilities licensed by the Ministry of Health. They provide clinical care—skilled nursing, medical treatment, rehabilitation. There are only 18 in the entire country, with roughly 730 beds total.

JKM-registered care centres (including “old folks homes”) are social welfare facilities registered with Jabatan Kebajikan Masyarakat. There are 489+ of these. They provide accommodation and daily assistance—but they’re not licensed to provide clinical care.

When families submit claims, insurers check whether care was received at a recognised healthcare facility. An MOH-licensed nursing home qualifies. A JKM-registered care centre doesn’t.

This single distinction often determines approval or denial.

What Medical Cards Actually Cover

Medical insurance covers acute hospital treatment—surgery, ICU, specialist consultations, room and board during hospitalisation.

Most policies include post-hospitalisation benefits: 90 to 365 days of coverage for follow-up consultations, physiotherapy, diagnostic tests, and medications.

The catch: Coverage typically stops once insurers classify care as “maintenance” or “custodial”—help with bathing, dressing, eating—rather than active treatment.

The Policy Wording That Catches Families Off Guard

Here’s something families deserve to know: some policies specify that post-hospitalisation nursing care must be received at the client’s residence—not at a healthcare facility.

The policy language is particular: “home nursing,” “domiciliary care,” “at the insured’s residence.”

The policy language is particular: “home nursing,” “domiciliary care,” “at the insured’s residence.”

Consider the practical reality. A stroke patient needs 24-hour skilled nursing supervision, wound care twice daily, catheter management, and intensive physiotherapy. The neurologist recommends a nursing home because this level of care cannot be safely provided at home.

But if the policy restricts coverage to home-based care, that nursing home stay becomes unclaimable—regardless of medical necessity.

What to do: Before assuming post-hospitalisation benefits will cover facility-based care, read policy wording carefully. Look for phrases like “home nursing,” “at residence,” or “domiciliary care.” Ask insurers directly: “Does my policy cover skilled nursing care at an MOH-licensed nursing home, or only at my home?” Get the answer in writing.

What Can Actually Be Claimed

Despite obstacles, successful claims at nursing homes are possible. Families have claimed both room and board and physiotherapy sessions from major insurers.

Key factors for successful claims:

- The facility holds a valid MOH nursing home license

- The policy doesn’t restrict coverage to home nursing only

- Proper documentation exists—doctor’s prescriptions, treatment records, itemised invoices

- Claims fall within the policy’s post-hospitalisation window

Insurers typically require proof of MOH licensing, official receipts, medical reports, and hospital discharge summaries.

Important: Unlike panel hospitals, nursing home care works on a self-pay-and-claim basis. Families pay upfront, then submit for reimbursement.

The Tax Relief Most Families Miss

Even if insurance doesn’t cover everything, medical expenses tax relief allows claims of up to RM10,000 for nursing home services, rehabilitation equipment, and care expenses for parents.

Requirements include original receipts and certification from an MMC-registered practitioner. For a three-month stay costing RM12,000-15,000, tax savings could reach RM1,200-3,600 depending on income bracket.

Questions to Ask Before Discharge

Ask the insurer (get it in writing):

- What’s covered under post-hospitalisation benefits?

- Does the policy cover nursing care at an MOH-licensed nursing home, or only at home?

- What documentation is required?

- What’s the time limit after discharge?

Ask the facility:

- “Are you licensed by the Ministry of Health as a nursing home?”

If they say “registered with JKM” or describe themselves as a “care centre,” they’re not MOH-licensed. Claims will almost certainly be denied.

The Bottom Line

Three things determine whether post-hospitalisation nursing care claims succeed:

- Facility type: MOH-licensed nursing home (not JKM-registered care centre)

- Policy wording: Coverage for facility-based care (not restricted to home nursing only)

- Documentation: Proper medical records, prescriptions, and itemised invoices

Get clarity on all three before crisis mode—not when making decisions under discharge pressure.

How BIGTREE Medicare Can Help

BIGTREE Medicare is one of Malaysia’s 18 MOH-licensed nursing homes—the only one headquartered in Melaka, with 106 licensed beds representing approximately 14.5% of national capacity.

As a recognised healthcare facility, documentation meets insurance requirements. Families have successfully claimed room and board and physiotherapy. Invoices support both insurance claims and tax relief applications.

Claim approval depends on individual policy terms and insurer decisions. BIGTREE Medicare provides the documentation needed for fair evaluation.

Contact:

- Call: +6012 685 5103

- Email: info@bigtree.care

- Web: www.bigtree.care

Insurance coverage varies by policy and circumstances. This is educational information, not financial advice. Consult insurers for policy-specific details.

Leave A Comment